Mobile Deposit

It’s easy, secure and convenient

Step 1

Login to your banking app and tap the button for mobile deposit.

Step 2

Endorse the back of the check with both your signature and Mobile deposit at FFSL.

Step 3

Take a picture of your check, front and back.

Step 4

Click Submit to deposit it into your account.

Mobile Deposit Tips

- Ensure check amount matches the amount written on your check.

- Flatten folded or crumpled checks before taking your photos.

- Keep the check within the view finder on the camera screen when capturing your photos.

- Take the photos of your check in a well-lit area with a solid dark background

- Make sure that the entire check image is visible (all four corners), no shadows and in focus before submitting your deposit.

- The MICR line (numbers on the bottom of your check) is readable.

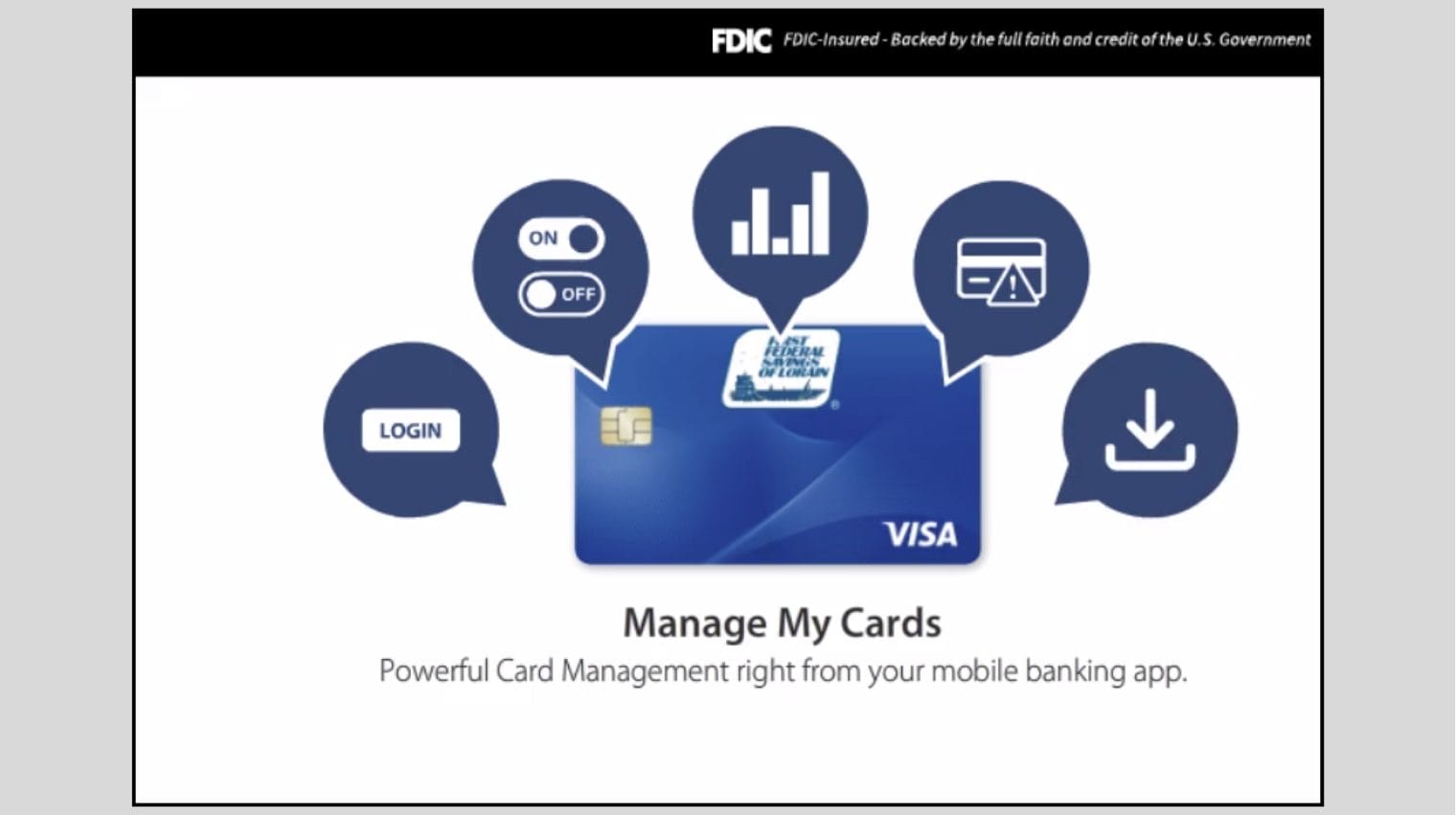

Manage My Cards

Keep tabs on your credit and debit card within the mobile banking app.

Lock and unlock your cards

Stay informed with alerts

Get transaction details

Limit transactions by location, merchant, transaction type or dollar amount

Quickly identify and report fraudulent transactions

Report lost or stolen cards

Set up and manage travel plans

Simply log in to the Mobile Banking App and tap” My Cards” to get started!

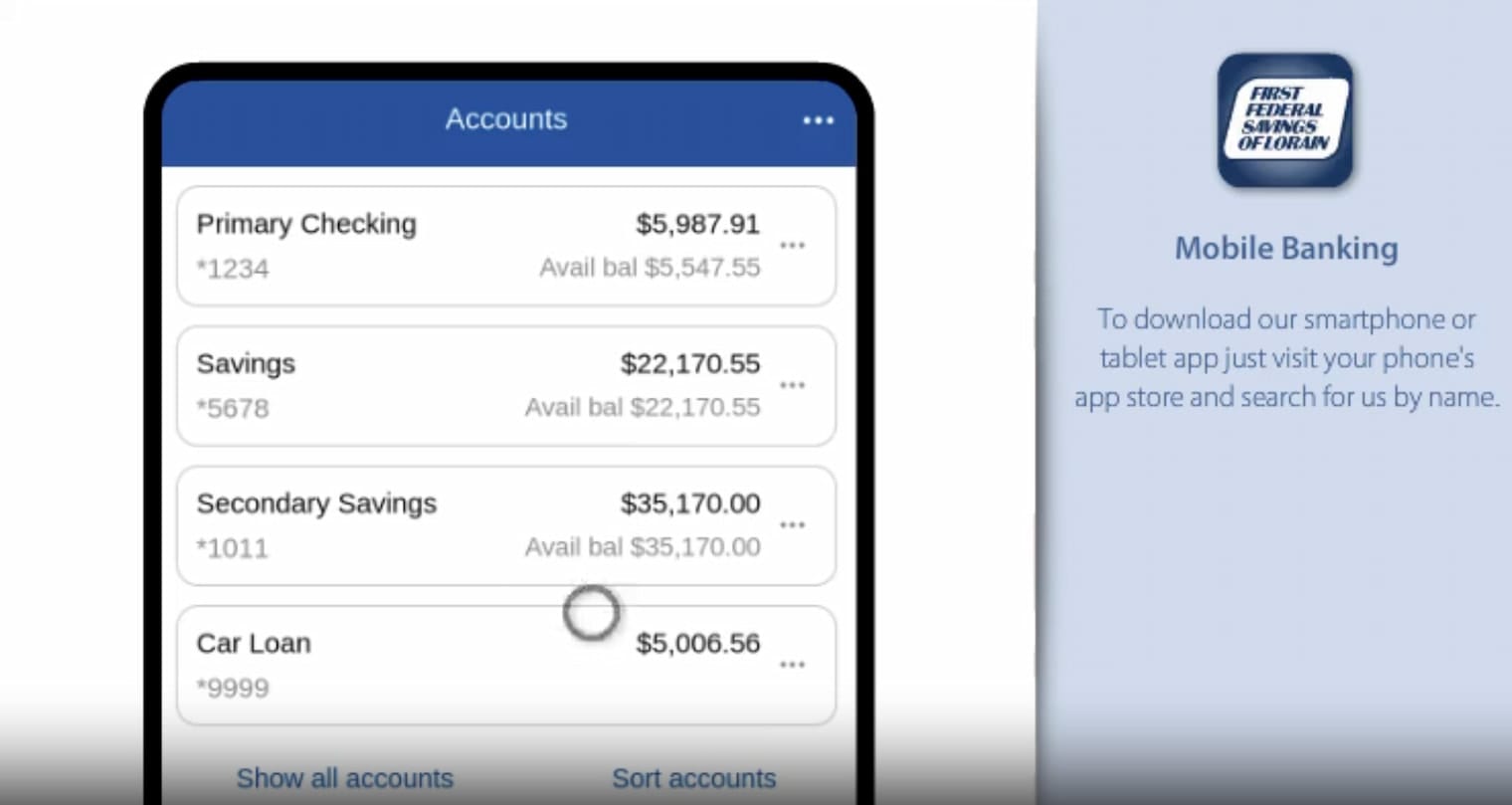

Bring Your Community Bank Wherever You Are

Do all your banking from the palm of your hand.

-

View balance information

-

Review detailed account activity

-

Transfer funds between your Accounts

-

Pay bills

-

Find an ATM or branch near you

-

Manage you card- lock and unlock your card

-

Set up and manage travel plans

Frequently Asked Questions

Sign into the mobile banking app, click the tab at the bottom of the screen labeled deposits.

Please note it may take up to 2 business days for a mobile deposit to be approved.

There are many reasons a mobile deposited check may be rejected, which can include but are not limited to: The endorsement on the check does not include “For FFSL Mobile deposit only”, It is a third-party check; we do not accept third party checks. Checks must be endorsed and deposited by the payee.

Your full account number can be obtained in the mobile banking app. Login, click the account you want to see the number for, at the top click the icon next to the last four digits of your account and the full account number will be displayed.

First Federal Savings of Lorain’s routing number is 241271342

Log into online banking

If you do not have online banking, you will need to enroll first: visit our E-Statements page

New Users to online banking continue with these steps after enrollment

- Click account tab

- Click documents

- A new window opens

- Click yes

- Review agreement and select I agree

- For more detailed directions visit our E-Statements page